Unknown Facts About Offshore Wealth Management

Table of ContentsOffshore Wealth Management for DummiesThe Main Principles Of Offshore Wealth Management All About Offshore Wealth ManagementHow Offshore Wealth Management can Save You Time, Stress, and Money.

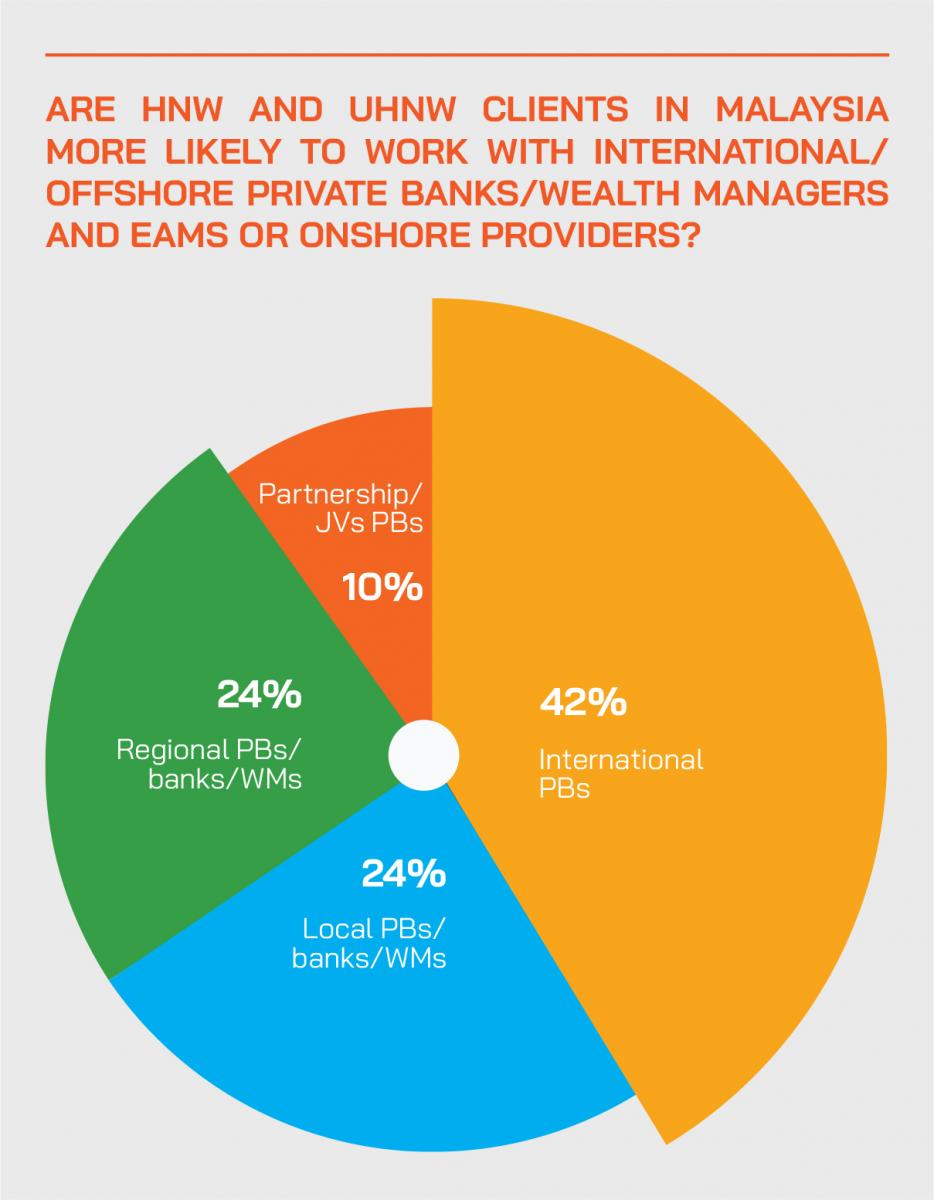

A winning combination, as a result, is frequently a mix of a solid regional gamer which has the customer insight and also physical existence, combined with an overseas gamer that offers the table the procedures as well as systems to guide this. Some care is, nonetheless, essential for overseas exclusive banks. They will often tend to have a much greater exposure to so-called tax-haven danger, offered the number of tax territories as well as rules the demand to conform with.

Instead, the emphasis must be on the company version. This means dealing with some difficult concerns, such as exactly how staff are awarded; the financial investment growth approaches; just how and also just how much customers are billed; as well as whether the marketplace generally, and also the banks and also their clients, prepare to change the means they function. offshore wealth management.

For the time being, at least, international private financial institutions as well as wealth centers such as Singapore as well as Hong Kong, continue to be aspirational change agents as fad leaders which establish the regional wide range monitoring requirements.

As a deportee there are a variety of things you'll need to consider, however your financial resources should be at the first. It's important to have a customized wealth management strategy that can assist you prepare for the future, as well as spending offshore can be a terrific method to do that.

The smart Trick of Offshore Wealth Management That Nobody is Talking About

Approval * I wish to obtain regular insights.

Our partners are carefully chosen from amongst the leaders in their area, to provide services that complement our wide range advisory method as well as improve your worldwide lifestyle (offshore wealth management).

The Greatest Guide To Offshore Wealth Management

Below's an intro to overseas investments and the main points to remember. For a UK capitalist, an overseas financial investment is one that holds your cash outside the UK. It might be a fund that purchases foreign companies, or similarly it might spend in British firms yet just be registered abroad.

If a fund is registered outside the UK, it may undergo various or lighter regulation than a UK fund. It may likewise have accessibility to a bigger variety of investments and economic products. This can create much more chances for creating greater returns although at the exact same time it may subject your cash to higher risk.

This suggests that these offshore funds reinvest development without paying tax obligation, which can boost their rate of return. Although this may not aid you straight as a UK-based financier (as you are still tired the same on any kind of earnings), this plan can save money for the fund firm itself, which might hand down some of the savings in bigger returns and/or reduced management costs.

If the nation where you are remaining has poor monetary law, you may favor investment funds based in more controlled territories. Lots of individuals presume that spending offshore is about paying less tax obligation.

Unknown Facts About Offshore Wealth Management

That is, your investments may grow faster in a low-regulation atmosphere however equally, they might decline just as sharply. Regulation functions both Learn More Here methods, because while it may lead to slower development, it also provides even more safeguards to you, the capitalist. When you spend with a fund that's registered outside the UK, you Recommended Reading waive the defense offered by residential laws in favour of a different environment.

The danger associated with any type of offshore fund depends greatly on the business in which it spends, as well as on the country where it is signed up. To put it simply, research study each one on its own benefits prior to making any type of choices. Offshore investing is extra usual than you could believe many pension plan funds and mutual fund have some offshore components in them - offshore wealth management.

Offshore investments are created with the aim of: Providing you with access to a more comprehensive variety of possession courses as well as money, Allowing for normal financial investment or as a one-off round figure, Increasing the development capacity of your financial investment, Spreading the threat of your investment, Using you accessibility to knowledgeable as well as skilled specialist fund managers, Providing you the alternative of a regular and predictable 'income'Allowing you to switch over in between funds quickly, Assisting you to possibly reduce your responsibility to earnings as well as capital gains tax obligations Offshore investments can be an attractive alternative read this in instances where: resources is set aside for a minoryou anticipate your marginal rate of tax to fall you are entitled to an age-related allowanceyou are an expatriate or are non-resident in the UKFor additional info, details to your situations, please contact us to review your needs, as the information provided is based on existing regulation and also HM Profits & Traditions practice and does not amount to tax obligation preparation advice.